Etowah County Al Property Taxes . property taxes are due october 1st and delinquent date is january 1st. welcome to the etowah county, alabama online record search. Enter the information into one of the fields below. Enter the information into one of the fields below. To view your property information: etowah county (0.37%) has a 5.1% lower property tax rate than the average of alabama (0.39%). property appraisal etowah county, al. This search engine will return property tax, appraisal and other. To view your property information: allows viewing access to etowah county revenue dept's map service hosted by kcs via esri's arcgis html5/javascript app. Cash, check, money order, cashier’s check, credit card,. property link etowah county, al.

from diaocthongthai.com

To view your property information: etowah county (0.37%) has a 5.1% lower property tax rate than the average of alabama (0.39%). To view your property information: Cash, check, money order, cashier’s check, credit card,. Enter the information into one of the fields below. Enter the information into one of the fields below. This search engine will return property tax, appraisal and other. property taxes are due october 1st and delinquent date is january 1st. property appraisal etowah county, al. welcome to the etowah county, alabama online record search.

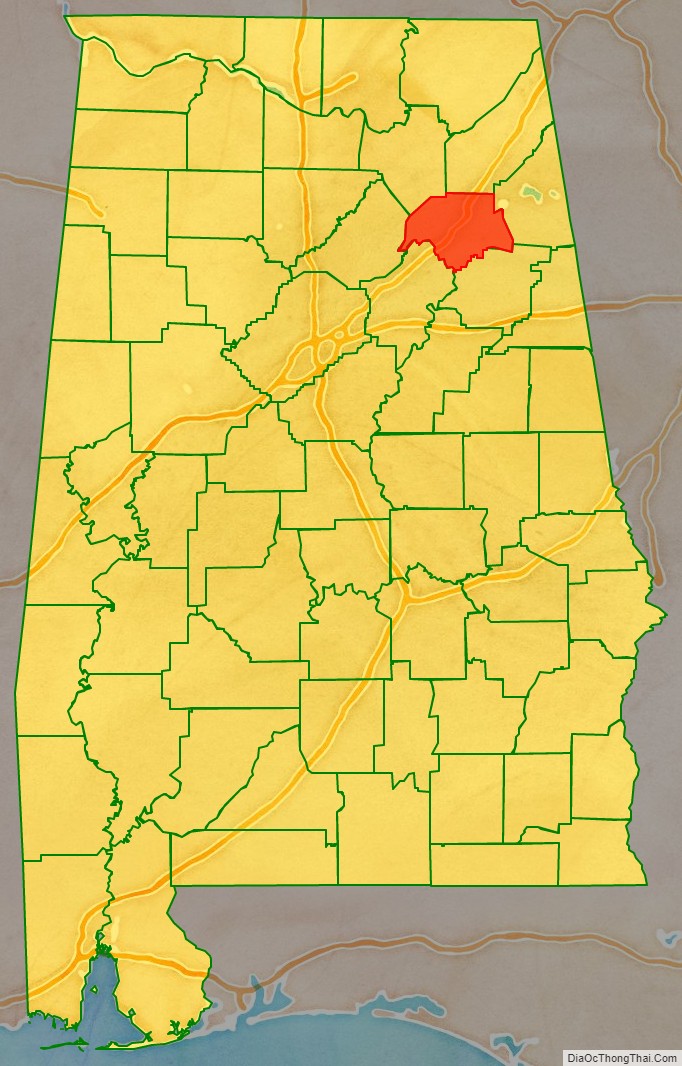

Map of Etowah County, Alabama Thong Thai Real

Etowah County Al Property Taxes To view your property information: property appraisal etowah county, al. To view your property information: Enter the information into one of the fields below. property link etowah county, al. Enter the information into one of the fields below. property taxes are due october 1st and delinquent date is january 1st. To view your property information: allows viewing access to etowah county revenue dept's map service hosted by kcs via esri's arcgis html5/javascript app. welcome to the etowah county, alabama online record search. etowah county (0.37%) has a 5.1% lower property tax rate than the average of alabama (0.39%). Cash, check, money order, cashier’s check, credit card,. This search engine will return property tax, appraisal and other.

From dxotuzmzz.blob.core.windows.net

Alabama Property Tax Payment at Dannie Cortez blog Etowah County Al Property Taxes Enter the information into one of the fields below. allows viewing access to etowah county revenue dept's map service hosted by kcs via esri's arcgis html5/javascript app. Cash, check, money order, cashier’s check, credit card,. This search engine will return property tax, appraisal and other. property link etowah county, al. property taxes are due october 1st and. Etowah County Al Property Taxes.

From www.countiesmap.com

Lauderdale County Alabama Property Maps Etowah County Al Property Taxes Enter the information into one of the fields below. allows viewing access to etowah county revenue dept's map service hosted by kcs via esri's arcgis html5/javascript app. Cash, check, money order, cashier’s check, credit card,. Enter the information into one of the fields below. welcome to the etowah county, alabama online record search. This search engine will return. Etowah County Al Property Taxes.

From etowahcounty.org

Etowah County Commissioners Etowah County Al Property Taxes Cash, check, money order, cashier’s check, credit card,. allows viewing access to etowah county revenue dept's map service hosted by kcs via esri's arcgis html5/javascript app. To view your property information: welcome to the etowah county, alabama online record search. Enter the information into one of the fields below. Enter the information into one of the fields below.. Etowah County Al Property Taxes.

From etowahcounty.org

Etowah County Courthouse Etowah County Al Property Taxes welcome to the etowah county, alabama online record search. Cash, check, money order, cashier’s check, credit card,. property link etowah county, al. Enter the information into one of the fields below. property appraisal etowah county, al. To view your property information: allows viewing access to etowah county revenue dept's map service hosted by kcs via esri's. Etowah County Al Property Taxes.

From www.financestrategists.com

Find the Best Tax Preparation Services in Etowah County, AL Etowah County Al Property Taxes This search engine will return property tax, appraisal and other. property taxes are due october 1st and delinquent date is january 1st. etowah county (0.37%) has a 5.1% lower property tax rate than the average of alabama (0.39%). allows viewing access to etowah county revenue dept's map service hosted by kcs via esri's arcgis html5/javascript app. Cash,. Etowah County Al Property Taxes.

From www.landwatch.com

Southside, Etowah County, AL Farms and Ranches, Horse Property Etowah County Al Property Taxes welcome to the etowah county, alabama online record search. etowah county (0.37%) has a 5.1% lower property tax rate than the average of alabama (0.39%). To view your property information: allows viewing access to etowah county revenue dept's map service hosted by kcs via esri's arcgis html5/javascript app. To view your property information: This search engine will. Etowah County Al Property Taxes.

From exoakuzpn.blob.core.windows.net

Washington Al Property Tax Search at Michelle Cavazos blog Etowah County Al Property Taxes welcome to the etowah county, alabama online record search. To view your property information: property appraisal etowah county, al. property link etowah county, al. Cash, check, money order, cashier’s check, credit card,. This search engine will return property tax, appraisal and other. Enter the information into one of the fields below. allows viewing access to etowah. Etowah County Al Property Taxes.

From dxojqfcgk.blob.core.windows.net

Property Tax Records Calhoun County Al at Sondra Faulkner blog Etowah County Al Property Taxes To view your property information: Enter the information into one of the fields below. welcome to the etowah county, alabama online record search. This search engine will return property tax, appraisal and other. property link etowah county, al. etowah county (0.37%) has a 5.1% lower property tax rate than the average of alabama (0.39%). property appraisal. Etowah County Al Property Taxes.

From whatsanswer.com

Escambia County Map Printable Gis Rivers map of Escambia Alabama Etowah County Al Property Taxes Enter the information into one of the fields below. Cash, check, money order, cashier’s check, credit card,. welcome to the etowah county, alabama online record search. To view your property information: etowah county (0.37%) has a 5.1% lower property tax rate than the average of alabama (0.39%). This search engine will return property tax, appraisal and other. To. Etowah County Al Property Taxes.

From diaocthongthai.com

Map of Etowah County, Alabama Thong Thai Real Etowah County Al Property Taxes property appraisal etowah county, al. To view your property information: etowah county (0.37%) has a 5.1% lower property tax rate than the average of alabama (0.39%). This search engine will return property tax, appraisal and other. Enter the information into one of the fields below. welcome to the etowah county, alabama online record search. Enter the information. Etowah County Al Property Taxes.

From etowahcounty.org

District 1 Map Etowah County Etowah County Al Property Taxes property appraisal etowah county, al. This search engine will return property tax, appraisal and other. property taxes are due october 1st and delinquent date is january 1st. allows viewing access to etowah county revenue dept's map service hosted by kcs via esri's arcgis html5/javascript app. Cash, check, money order, cashier’s check, credit card,. Enter the information into. Etowah County Al Property Taxes.

From www.landwatch.com

Gadsden, Etowah County, AL House for sale Property ID 415258334 Etowah County Al Property Taxes welcome to the etowah county, alabama online record search. Cash, check, money order, cashier’s check, credit card,. Enter the information into one of the fields below. Enter the information into one of the fields below. To view your property information: To view your property information: property link etowah county, al. etowah county (0.37%) has a 5.1% lower. Etowah County Al Property Taxes.

From dxovbottd.blob.core.windows.net

Property Tax Laws In Alabama at Victor Shoemaker blog Etowah County Al Property Taxes To view your property information: Enter the information into one of the fields below. To view your property information: Cash, check, money order, cashier’s check, credit card,. property link etowah county, al. property appraisal etowah county, al. property taxes are due october 1st and delinquent date is january 1st. etowah county (0.37%) has a 5.1% lower. Etowah County Al Property Taxes.

From liveetowah.com

Live Etowah Location Etowah County Al Property Taxes Enter the information into one of the fields below. property appraisal etowah county, al. Enter the information into one of the fields below. This search engine will return property tax, appraisal and other. Cash, check, money order, cashier’s check, credit card,. property link etowah county, al. property taxes are due october 1st and delinquent date is january. Etowah County Al Property Taxes.

From dxogbxcye.blob.core.windows.net

Property Taxes By County Alabama at Antonio Redd blog Etowah County Al Property Taxes property taxes are due october 1st and delinquent date is january 1st. welcome to the etowah county, alabama online record search. etowah county (0.37%) has a 5.1% lower property tax rate than the average of alabama (0.39%). Cash, check, money order, cashier’s check, credit card,. To view your property information: Enter the information into one of the. Etowah County Al Property Taxes.

From dxomrvsoo.blob.core.windows.net

Colbert Alabama Tax Assessor at Kevin Churchill blog Etowah County Al Property Taxes Cash, check, money order, cashier’s check, credit card,. welcome to the etowah county, alabama online record search. Enter the information into one of the fields below. allows viewing access to etowah county revenue dept's map service hosted by kcs via esri's arcgis html5/javascript app. To view your property information: property appraisal etowah county, al. etowah county. Etowah County Al Property Taxes.

From exoxulnnf.blob.core.windows.net

Parker County Real Estate Taxes at Dana Wild blog Etowah County Al Property Taxes Cash, check, money order, cashier’s check, credit card,. property link etowah county, al. This search engine will return property tax, appraisal and other. Enter the information into one of the fields below. allows viewing access to etowah county revenue dept's map service hosted by kcs via esri's arcgis html5/javascript app. property appraisal etowah county, al. To view. Etowah County Al Property Taxes.

From www.landwatch.com

Gadsden, Etowah County, AL House for sale Property ID 415682374 Etowah County Al Property Taxes This search engine will return property tax, appraisal and other. To view your property information: Enter the information into one of the fields below. property link etowah county, al. property taxes are due october 1st and delinquent date is january 1st. Cash, check, money order, cashier’s check, credit card,. property appraisal etowah county, al. Enter the information. Etowah County Al Property Taxes.